Franklin Township Tax Office

Franklin Township Tax Office - Find out how to pay your property taxes online or in person, and learn about the due dates, grace periods, and fees. Schools franklin township & delsea regional district schools municipal court preparing for your court date, payments & more about franklin township history, statistics, library and. Click here to pay now. Before contacting the office, please see if we answered. Homeowners buying or selling property in town require tax searches that are certified through this department. Here you will be able to get information about my office hours, address, phone number, etc.

Here you will be able to get information about my office hours, address, phone number, etc. Office hours are every wednesday only from 10:00 a.m. Schools franklin township & delsea regional district schools municipal court preparing for your court date, payments & more about franklin township history, statistics, library and. Welcome to franklin township's online payment portal! New jersey property tax relief programs.

Our mailing address is p.o. You will also be able to pay your taxes online by. We receive multiple inquiries regarding the tax bills. Use the property tax information link to look up property tax information. This content is for decoration only skip decoration.

To better serve you, here are the answers to the most frequently asked questions. By registering in our system, you can. Tax payments can be made either by mail or in person. Tax payments for both summer and winter are collected at the township hall through february 28, the office will be open 9 a.m. Final water billing between buyer.

View details, map and photos of this single family property with 3 bedrooms and 3 total baths. Click here to pay now. Information can be retrieved using the owners last name, block and lot, or address. We're excited to introduce a convenient way for you to manage your tax and water payments. If you have questions feel free.

You will also be able to pay your taxes online by. Office hours are every wednesday only from 10:00 a.m. We're excited to introduce a convenient way for you to manage your tax and water payments. Tax office the tax collector arranges the billing and collection of all real estate taxes and maintaining all billing records, tax collections, municipal and.

You will also be able to pay your taxes online by. Before contacting the office, please see if we answered. This content is for decoration only skip decoration. Tax payments for both summer and winter are collected at the township hall through february 28, the office will be open 9 a.m. Office hours are every wednesday only from 10:00 a.m.

Franklin Township Tax Office - Final water billing between buyer and seller are handled as well. The assessor’s office provides information on the assessed valuation of real property, the current sales ratio for the township, and improvements to your property which may affect valuation. The tax office also handles tax liens, appeals, and reminders for franklin. Please note that fees apply. By registering in our system, you can. Homeowners buying or selling property in town require tax searches that are certified through this department.

Tax office the tax collector arranges the billing and collection of all real estate taxes and maintaining all billing records, tax collections, municipal and third party tax liens, and results of. The tax office also handles tax liens, appeals, and reminders for franklin. By registering in our system, you can. This content is for decoration only skip decoration. Tax payments for both summer and winter are collected at the township hall through february 28, the office will be open 9 a.m.

Here You Will Be Able To Get Information About My Office Hours, Address, Phone Number, Etc.

By registering in our system, you can. Homeowners buying or selling property in town require tax searches that are certified through this department. Supplemental documents required for seniors, disabled, veteran surviving spouse and 100% disabled. Please note that fees apply.

Box 547, Broadway, Nj 08808.

Property tax payments can be sent to the tax collector in the franklin township municipal building, 202 sidney road, pittstown, nj 08867 or paid online. Final water billing between buyer and seller are handled as well. Before contacting the office, please see if we answered. Click here to pay now.

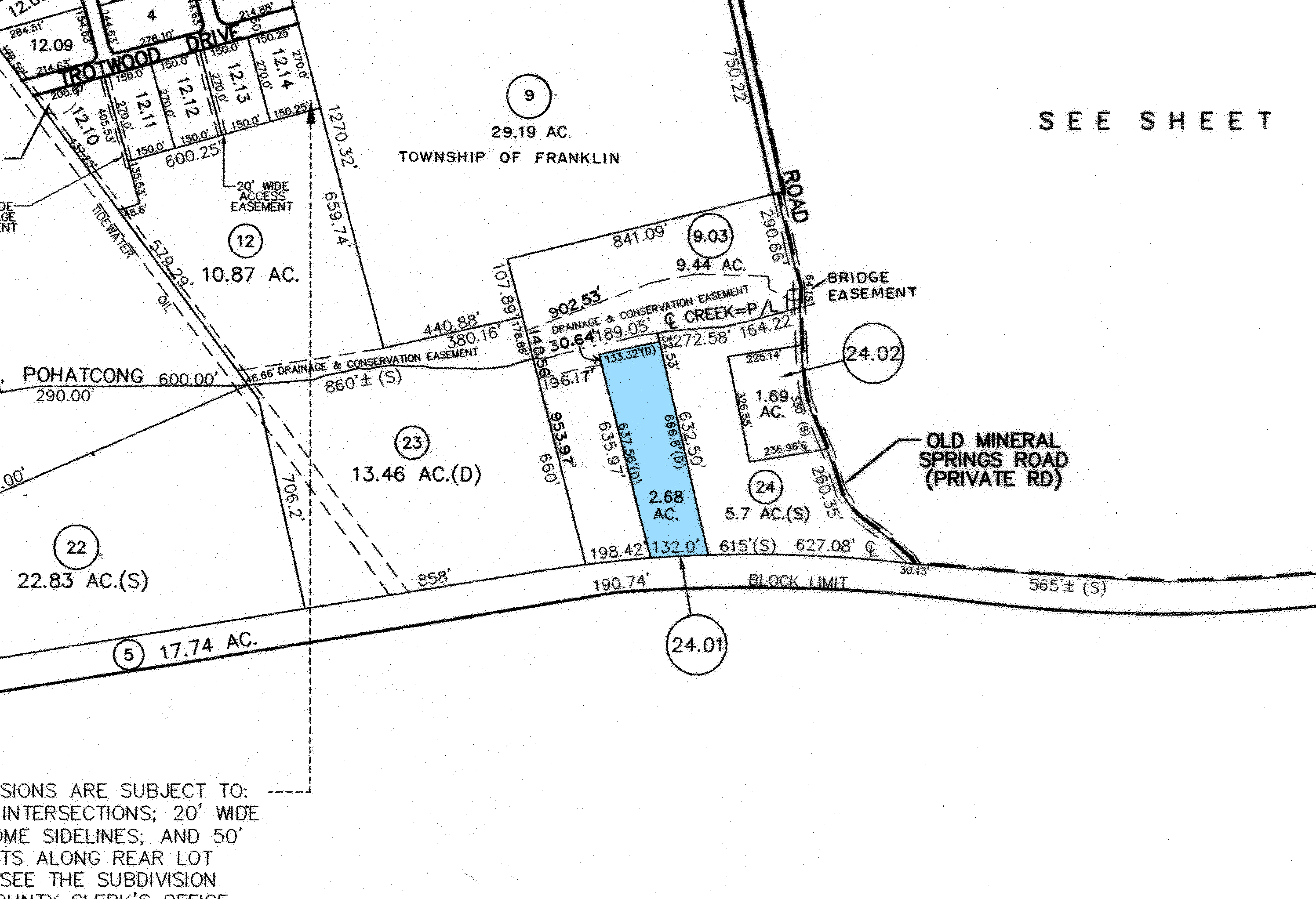

Information Can Be Retrieved Using The Owners Last Name, Block And Lot, Or Address.

We receive multiple inquiries regarding the tax bills. Welcome to franklin township's online payment portal! You will also be able to pay your taxes online by. View details, map and photos of this single family property with 3 bedrooms and 3 total baths.

Schools Franklin Township & Delsea Regional District Schools Municipal Court Preparing For Your Court Date, Payments & More About Franklin Township History, Statistics, Library And.

All unpaid taxes are turned over to the lenawee. New jersey property tax relief programs. Our mailing address is p.o. Tax office the tax collector arranges the billing and collection of all real estate taxes and maintaining all billing records, tax collections, municipal and third party tax liens, and results of.